最高のコレクション 3/1/2018-igst 309247

IGST Notification 2 18 gstindiaguide To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customs Notification No 02/18 – Integrated Tax New Delhi, the th September, 18 GSR (E)— In exercise of the powers1 Short title, extent and commencement— (1) This Act may be called the Integrated Goods and Services Tax Act, 17 (2) It shall extend to the whole of India *****1 (3) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint Provided that different dates may be appointed for different provisions of this Act and anyForms SGST – Chhattisgarh;

Analysis Of 3 Gst Circulars Issued By Cbic On 18th February 19

3/1/2018-igst

3/1/2018-igst-Accounts and Records Forms;Returns / Statements Forms;

2

4 4 2*3 $ 1 / 9 1 #6 II ;6 ' 6 ; Circular No IGST F No CBEC// GST Government of India Ministry of Finance Department of Revenue Central Board of Indirect Taxes and Customs GST Policy Wing New Delhi, Dated the 25 th May, 18 To, The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of Central Tax (All)/ The PrincipalCGST & SGST or IGST are automatically calculated for you in Aster Billing Online You just need to add the corresponding tax rate and the breakdown is done for you, easy as pie Access your business from anywhere With a cloud based GST billing software, you can access all your documents and create invoices on the go It works on any operating system, computer or tablet,

Notification No 1/18 Services Tax Act, 17 (12 of 17) (hereafter in this notification referred to as the "IGST Act"), on the recommendations of the Council, the Central Government hereby makes the following amendment in the notification of the Government of India in the Ministry of Finance, Department of Revenue No 11/17 Integrated Tax dated the 13th October, 17, Note The IGST Act, 17 has been notified vide GOI Notification dt , which has subsequently been amended through IGST (Amendment) Act, 18 Finance Act, 19 , Finance Act, , Finance Act, 21 , including various Notifications issued by the Govt/ CBIC from time to time, relating to the commencement dates of various Sections/ Provisions in theIGST Notification 1 18 gstindiaguide To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) Government of India Ministry of Finance Department of Revenue Central Board of Excise and Customs Notification No 1/18 – Integrated Tax New Delhi, the 23 rd January, 18 GSR(E) In exercise of the

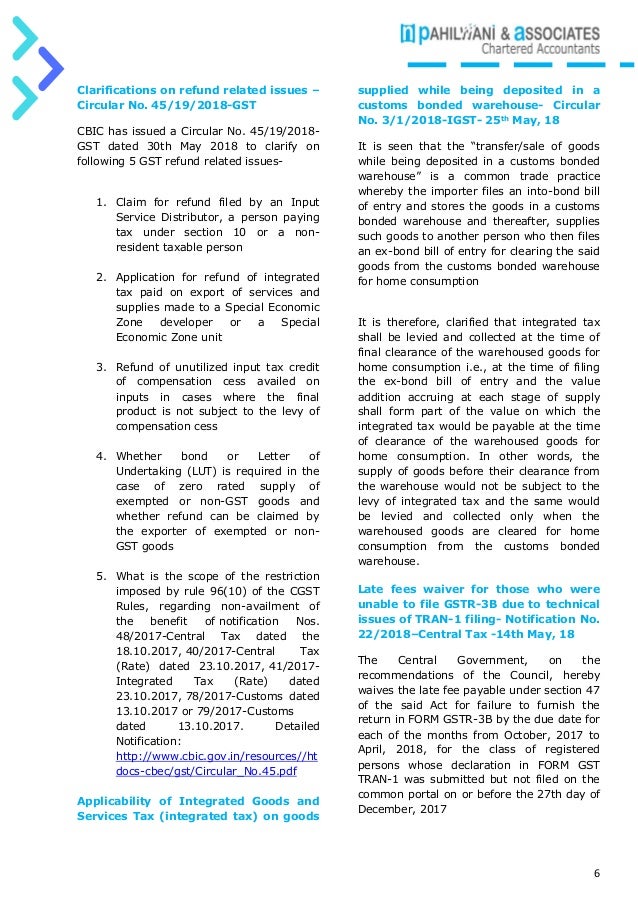

Input Tax Credit Forms;May 18 CBIC issues clarification on mechanics of charging IGST on goods supplied from customs bonded warehouse Central Board of Indirect Taxes and Customs (CBIC) has issued circular no 3/1/18IGST dated 25 May, 18 clarifying certain aspects regarding levy of IGST on goods supplied from the customs bonded warehouse (CBW)IGST Not No 1/17 Dated IGST Rate CGST Not No 1/17 Dated CGST Rate UTGST Not No 1/17 Dated UTGST Rate 001 0402 91 10, 0402 99 Omitted Notes As omitted by notification no 43/17 dated wef 002 1107 Malt, whether or not roasted 003 1302 Vegetable saps and extracts;

Analysis Of 3 Gst Circulars Issued By Cbic On 18th February 19

Supply Of Goods Outside India From Vendor S Premises Located Outside India Is Covered Under Gst Faceless Compliance

Summary of Circular No 3/1/18 IGST Applicability of Integrated Goods and Services Tax (integrated tax) on goods supplied while being deposited in a customs bonded warehousereg via Circular No 3/1/18 IGST Dated 25th May, 18 This circular rescinded by Circular No IGST dated No GST on supply of warehoused goods 1 CBEC amends Notification related to concessional IGST rate on scientific equipments Notification No 10/18 Integrated Tax (Rate) 2 CBEC notifies Changes in Rate of IGST on Motor Vehicle wef Notification NoAccount Number ;

Gstkarnataka Gov In

Ucci Bnl January March 19

Clarification on Interstate movement of various modes of conveyance, carrying goods or passengers or for repairs and maintenance regarding Circular No 1/1/17IGST F No 354/119/17 –TRU (Pt) Government of India Ministry of Finance Department of Revenue Tax Research Unit North Block, New Delhi Dated the 7th of July, 17 To, The Principal Chief Circular No 3/1/18IGST, (F No CBEC// GST), Applicability of Integrated Goods and Services Tax (integrated tax) on goods supplied while being deposited in a customs bonded warehouseregDouble Entry Book Keeping Ts Grewal 18 Solutions for Class 11 Commerce Accountancy Chapter 10 Trial Balance are provided here with simple stepbystep explanations These solutions for Trial Balance are extremely popular among Class 11 Commerce students for Accountancy Trial Balance Solutions come handy for quickly completing your homework and preparing for exams All

2

Cexcusner Gov In

July, 18, published in the Gazette of India, Extraordinary, Part II, Section 3, (1) (2) (3) 1 Leather articles (including bags, purses, saddlery, harness, 41, 42, 43 garments) 2 Carved wood products (including boxes, inlay work, cases, casks) 4415, 4416 3 Carved wood products (including table and kitchenware) 4419 4 Carved wood products 44 5 Wood turning and Circular No 3/1/18IGST F No CBEC// GST Government of India Ministry of Finance Department of Revenue Central Board of Indirect Taxes and Customs GST Policy Wing New Delhi, Dated the 25th May, 18 To, The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of CentralIFSC Code PUNB;

Goagst Gov In

Asa In

If IGST paid on exports has been declared as ZERO in Table 31(b), whereas, IGST shown to have been paid under Table 6A of GSTR 1 for that tax period, the correct amount can be declared and offset while filing GSTR 3B of subsequent tax period If IGST paid on exports declared in Table 31(b) is lesser that the total IGST shown to have been paid under Table 6A and Table Circular No 3/1/18IGST 5 It may also be noted that subsection (8A) has been inserted in section 3 of the CTAvide section 102 of the Finance Act, 18,with effect from 31st March, 18,so as to providethat the valuation for the purpose of levy of integrated tax on warehoused imported goods atthe time of clearance for home consumption would be either theBank Name Punjab National Bank;

Icmai In

India Cbic Issues Clarification On Mechanics Of Charging Igst On Goods Supplied From Customs Bonded Warehouse Michaela Merz

1 IGST Refund module for exports is operational in ICES since As per Rule 96 of the CGST Rules 17, dealing with refund of IGST paid on goods exported out of India, the shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India, once both the export general manifest (EGM) and valid return in 4 In respect of guidelines provided in Para 3A and 3B of the said Circular 12/18Customs, dated the comparison between the cumulative IGST payments in GSTR1 and GSTR 3B would now be for the period April 19 to March 2118 or tax invoice is on or after The TDS provisions apply when payment is made or credited to supplier Thus, if advance is paid on or after , TDS provisions will apply Similarly, if supply is made before but invoice

Amendments Brought Out With Effect From February 1 19 Gstindiaguide

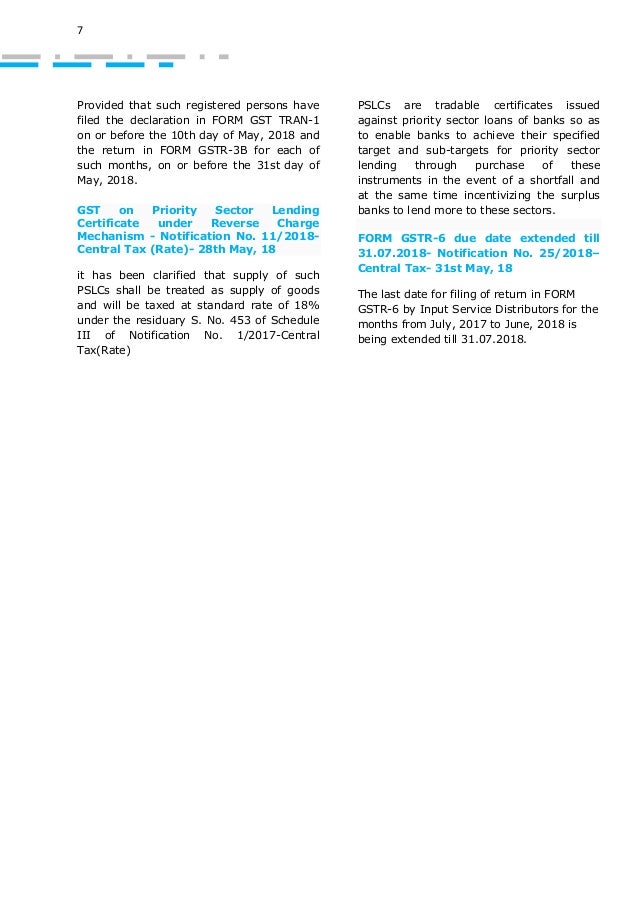

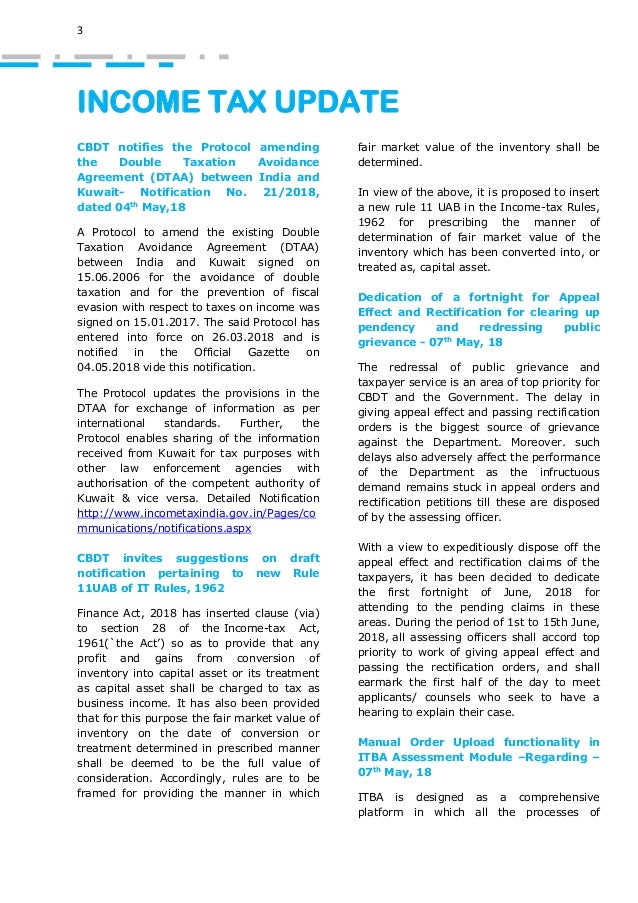

June Monthly Newsletter N Pahilwani Associates

Circular No IGST F No CBEC// GST Government of India Ministry of Finance Department of Revenue Central Board of Indirect Taxes and Customs GST Policy Wing New Delhi, Dated the 25th May, 18 To, The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of Central Tax (All)/ The PrincipalMr A manufactured and exported goods worth Rs 10,00,000 to Mr B of UK on 1st January, 18 and availed duty drawback of Rs 16,000 Mr A imported the same goods on 8th February, 18 What will be the customs duty payable by Mr A, if rate of basic customs duty is 10% and goods are exempt from IGST and GST cess?Account Number ;

E Bulletin

Insights Encomply

For Example we pay 18, as IGST being 18% of Rs1,00,000/ Commission Whether we can deduct Rs18,000/ from the CGST payable directly or Rs9, each from CGST ans SGST respectively AV John Sebastian Cherian On I'm an NRII bought goods worth Rs1000 from a nearby shop and paid GST Rs180Thus total invoice value is Rs1180I Archives Circular No 3/1/18 IGST Circular No 3/1/18 IGST Goods supplied from customs bonded warehouse IGST Applicability By CA Satbir Singh(a) 16,000 (b) 1,00,000 (c)1,10,000 (d) 1,26,000 Ans (a)

Itr Form Itw Pages 1 49 Flip Pdf Download Fliphtml5

2

IGST Notification 1 18;TO BE PUBLISHED IN PART II, SECTION 3, SUBSECTION (i) OF THE GAZETTE OF INDIA, EXTRAORDINARY GOVERNMENT OF INDIA MINISTRY OF FINANCE (Department of Revenue) Notification No 19/18Integrated Tax (Rate) New Delhi, the 26th July, 18 GSR (E) In exercise of the powers conferred by subsection (1) of section 5 of the Integrated Goods and 3/1/18IGST Applicability of Integrated Goods and Services Tax (integrated tax) on goods supplied while being deposited in a customs bonded warehousereg Circular No 3/1/18IGST FNo CBEC// GST Government of India Ministry of Finance

2

Insta Instavat In

IFSC Code PUNB;Sold goods at Varanasi (UP) Costing ₹ 2,25,000 at 33 1 3 % profit less trade discount 10% against cheque which was deposited into bank March Paid rent ₹ 25,000 by cheque2 stThis notification shall come into force on the 1 January, 19 FNo354/432/18TRU (Gunjan Kumar Verma) Under Secretary to the Government of India Note The principal notification No1/17Integrated Tax (Rate), dated the 28th June, 17 was published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i), vide number GSR 666(E), dated the 28th

Analysis Of 3 Gst Circulars Issued By Cbic On 18th February 19

Clarification On Payment Of Cgst Sgst Instead Of Igst For Supply Of Warehoused Goods For The Period July 17 To Mar 18 Bharatax

Step1 On preparation of list by custom wings, a list will be prepared of such exporters whose payment of IGST (as declared in Table 31(a) and Table 31(b) of GSTR3B) is less then IGST payable as per sales declared in GSTR1 for the period of 1 st July, 17 to 31 st March, 18 Custom policy wing shall share the list of such exporters with GSTN and all chief 18 04/18Integrated Tax, dt View Seeks to amend the IGST Rules, 17 so as to notify the rules for determination of place of supply in case of interState supply under sections 10(2), 12(3), 12(7), 12(11) and 13(7) of the IGST Act, 17 03/18Integrated Tax, dt View देखेंGST Practitioners Forms ;

Idtc Icai S3 Amazonaws Com

Gst Update Circulars Issued By Cbic Related To Returns Invoices

18 Transaction May 1 Bought from M/s Chunni Lal Mam Raj, Delhi 100 bags of ITC Wheat Atta @ Rs 530 per bag 50 bags of Rice Basmati @ Rs 500 per bag Less Trade Discount @ 10% CGST and SGST @ 6% each was payable on the purchases May 3 Bought from M/s Kanodia Oil Mills, Delhi 40 tins Oil @ Rs 1,500 per tin tins Banaspati Oil @ Rs 900 per tin Less Trade DiscountPayment of Tax (Challan) Forms;The Integrated Goods and Service Tax Act

Goods Services Applicability Of Integrated Goods And Services Tax Integrated Tax On Goods Supplied Pdf Document

Gstindiapathway Org

CBEC notifies as the Commencement date for Section 12 of the IGST Act 17, vide Integrated Tax Notification 3/17 dt 2 Proviso to subsection (8) inserted vide the IGST (Amendment) Act, 18 GOI Notification dt 30 Aug 18 , followed with CBIC Notification on commencement date of 1st Feb 19 vide Notification 1/19 Integrated Tax dt 29 Jan 193 Withdraw Money from your wallet I request you to kindly fill in the following details Submit My team will verify your details And pay you money in next 12 hours Manual 1 Deposit money with Thakurani The details to make transfer are Beneficiary Name Thakurani Private Limited;Refund Forms (Central) Assessment Forms;

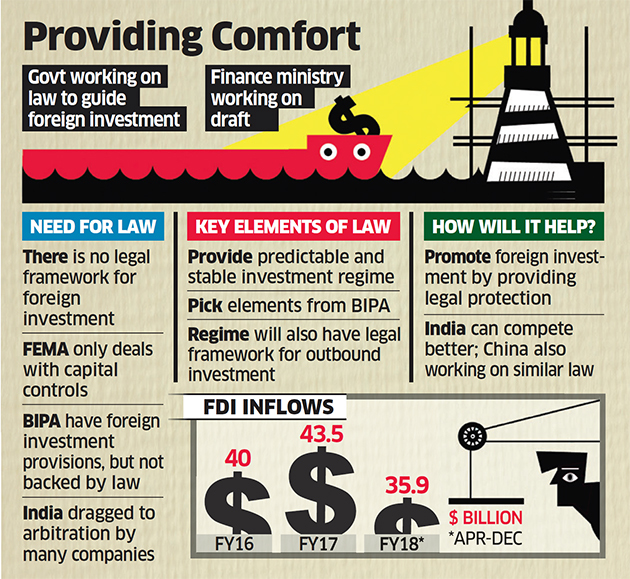

Legal Shield In The Works For Foreign Investments Neeraj Bhagat Co

Goods And Service Tax Gst Project Transactions Finance Dynamics 365 Microsoft Docs

seeks to amend Notification No1/17IGST (Rate) 06/18Integrated Tax (Rate), dt View देखें Seeks to exempt royalty and license fee from Integrated tax to the extent it is paid on the consideration attributable to royalty and license fee included in transaction value under Rule 10(1)(c) of Customs Valuation (Determination of value of imported Goods) CIRCULAR NO3/1/18IGST, DATED Attention is invited to Circular No 46/17Customs dated whereby the applicability of integrated tax on goods transferred/sold while being deposited in a warehouse (hereinafter referred to as the "warehoused goods") was clarified 2 Various references had been received by the Board on the captionedThe genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 06, wherein the then Finance Minister laid down 1st April, 10 as the date for the introduction of GST in the country Thereafter, there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the

Anu Gupta Account Executive Ved Jain Associates Linkedin

June Monthly Newsletter N Pahilwani Associates

IGST is levied @12% on interstate sale and purchase Solution Question 10 Journalise the following transactions of Ram Delhi CGST and SGST is levied @ 6% each on intrastate sale and purchase IGST is levied @12% on interstate sale and purchase Solution Question 11 Following transactions of Ramesh Delhi for April, 18 are given below Journalise them CGST and SGSTCircular No 3/1/18IGST 5 It may also be noted that subsection (8A) has been inserted in section 3 of the CTA vide section 102 of the Finance Act, 18,with effect from 31st March, 18,so as to provide that the valuation for the purpose of levy of integrated tax on warehoused imported goods at the time of clearance for home consumption would be either the transaction 3/1/18IGST Circular No 3 1 18 IGST F No CBEC 16 03 17 GST Government of India Ministry of Finance Department of Revenue Central Board of

Clarification On Payment Of Cgst Sgst Instead Of Igst For Supply Of Warehoused Goods For The Period July 17 To Mar 18 Bharatax

Insights Encomply

Schedule III of the CGST Act, 17 has been amended vide section 32 of the CGST (Amendment) Act, 18 so as to provide that the "supply of warehoused goods to any person before clearance for home consumption" shall be neither a supply of goods nor a supply of services 2 Accordingly, Circular No IGST dated 25th May, 18 is (3) The Government may, if it considers necessary or expedient so to do for the purpose of clarifying the scope or applicability of any notification issued under subsection (1) or order issued under subsection (2), insert an Explanation in such notification or order, as the case may be, by notification at any time within one year of issue of the notification under subsectionAuthor Admin Created Date AM

Cexraipur Gov In

You Know Your Gst Well It Just Changed Again Deccan Herald

Bank Name Punjab National Bank;< ( # ) K NOTIFICATION New Delhi, the 25th January, 18 No 10/18Integrated Tax (Rate) GSR 87(E)—In exercise of the powers conferred by subsection (1) of section 6 of the Integrated Goods and Services Tax Act, 17 (13 of 17), (hereafter in this notification referred to as "the said Act") read with subsection (3) of section 6 of the NOTIFICATION NO 04/18Integrated Tax,dt Seeks to amend the IGST Rules, 17 so as to notify the rules for determination of place of supply in case of interState supply under sections 10(2), 12(3), 12(7), 12(11) and 13(7) of the IGST Act, 17 TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUBSECTION

2

2

THE INTEGRATED GOODS AND SERVICES TAX ACT, 17 (IGST ACT) An Act to make a provision for levy and collection of tax on interState supply of goods or services or both by the Central Government and for matters connected therewith or incidental thereto BE it enacted by Parliament in the Sixtyeighth Year of the Republic of India as follows— CHAPTER I PRELIMINARY Section 13 Withdraw Money from your wallet I request you to kindly fill in the following details Submit My team will verify your details And pay you money in next 12 hours Manual 1 Deposit money with Thakurani The details to make transfer are Beneficiary Name Thakurani Private Limited;

Cexcusner Gov In

Epces In

File Letter Of Undertaking Lut In Gst

Nacin Gst Update 26 May 18 Gstindiaguide

2

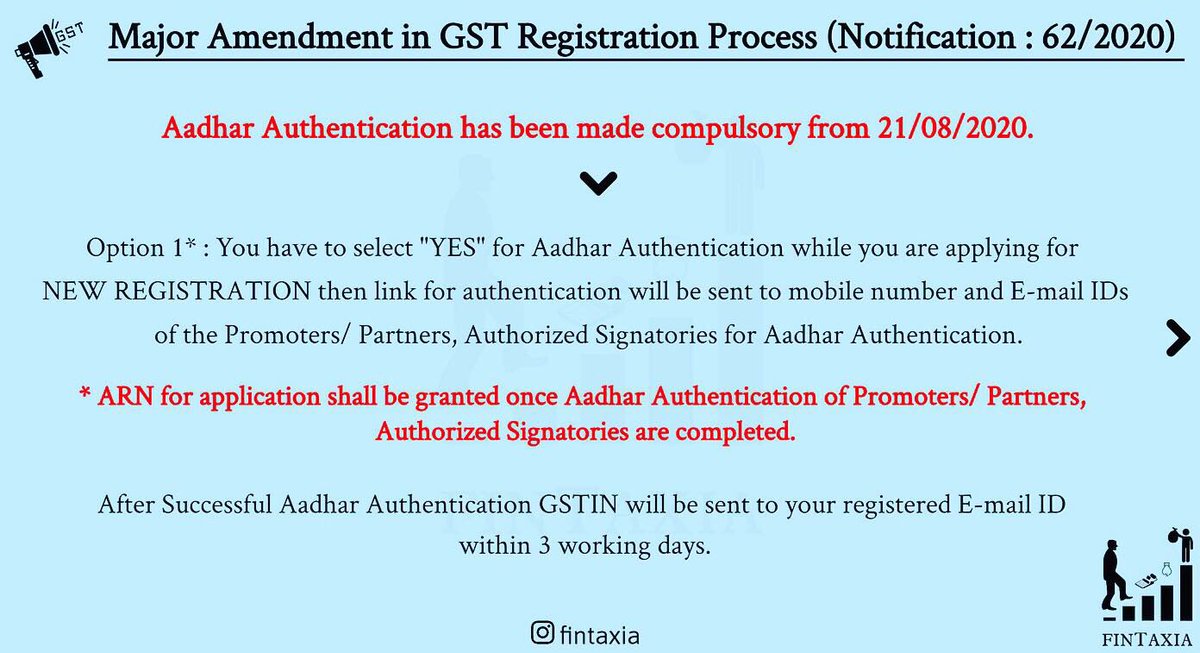

Amendments Notifications Circulars And Orders From 01 02 19 To 31 03 19

Khiwani Co Posts Facebook

Cbic Michaela Merz

Updates Being Announced By Cbic On Gst Feb Gst Updates By Cbic

Odishatax Gov In

2

Home Page Of Central Board Of Excise And Customs

Insta Instavat In

Amendments Brought Out With Effect From February 1 19 Gstindiaguide

June Monthly Newsletter N Pahilwani Associates

W Retaining The Bill Till Due Date Pebruary 18 Ii 3rd July 17 Iii 1st March 18 4 Months 2 On 10th March 18 A Draws On B A Bill At 3

91 19 Every Latest Information About Gst In India

2

2

Icsi Edu

2

Insights Encomply

2

2

Correct Time Home Facebook

No Gst On Sale Of Goods From Outside India To A Place Outside India

Circulars Igst Gstindiaguide

2

2

Centralexcisechennai Gov In

2

Circular No 91 10 19 Gst Seeks To Give Clarification Regarding Tax Payment Made For Supply Of Warehoused Goods While Being Deposited In A Customs Bonded Warehouse For The Period July 17 To March 18 Taxcharcha

Gstcircular

2

2

2

2

Applicability Of Igst On Goods Transferred Sold While Being Deposited In A Warehouse Akgvg Blog

Igst Applicable At The Time Of Final Clearance Of The Warehoused Goods

2

2

Goods Services Applicability Of Integrated Goods And Services Tax Integrated Tax On Goods Supplied Pdf Document

Welcome To Robert Kennedy M Chartered Accountant

2

Integrated Goods And Services Tax Circular Gst Online Com

June Monthly Newsletter N Pahilwani Associates

Icsi Edu

Nacin Gst Update 26 May 18 Gstindiaguide

2

Cexcusner Gov In

2

2

Gst Not Payable On Good Supplied Outside Taxable Territory From A Place Located Outside Taxable Territory

2

2

2

Circular No 3 Igst Pdf Customs Taxes

No Gst On Sale Of Goods From Outside India To A Place Outside India

June Monthly Newsletter N Pahilwani Associates

Cexcusner Gov In

June Monthly Newsletter N Pahilwani Associates

Circular No 3 1 18 Igst F No Cbec 16 03 17 New Delhi Dated The 25th May 18

Recent Changes In Gst

Icsi Edu

Insta Instavat In

Goods And Service Tax Gst Project Transactions Finance Dynamics 365 Microsoft Docs

コメント

コメントを投稿